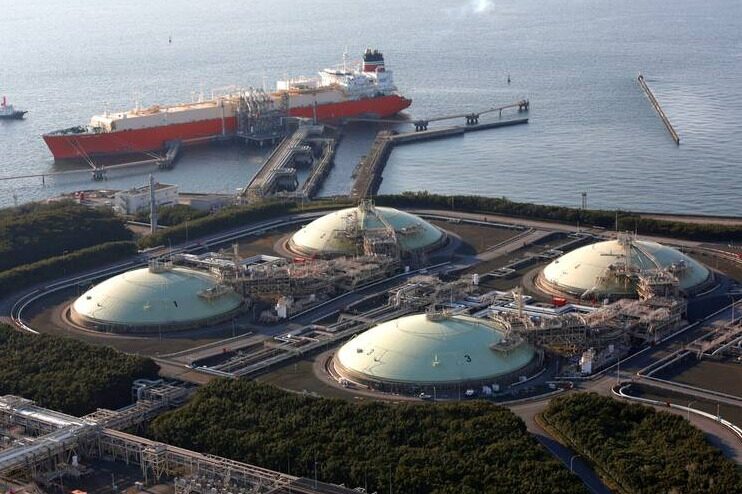

- In January 2021, Asian LNG prices hit a record high of US$32.50, which is close to the oil equivalent of US$190 per barrel.

Since the beginning of the Covid-19 pandemic, the energy sector’s attention has focused on the turmoil in the oil market and emerging green energy technologies. Another key energy source has gone through a dull decade. However, with the setting of natural gas price records and the entanglement of geopolitics, natural gas has made a comeback.

For more than a decade, the price of natural gas in the United States has been at a low level. They crashed during the 2008 financial crisis, and since then, the torrent of shale gas has almost always been less than the British thermal unit (Btu) of US$3, which is equivalent to US$17 per barrel of oil. Many companies are beginning to export LNG to other parts of the world to ease the surplus.

Prices in other places have been higher, but they are generally suppressed. Traditionally, the price of LNG in Asia is mainly determined by oil. At the end of 2014, the price of LNG fell together with the price of crude oil, generally hovering between US$5 and US$10 per million Btu per million barrels. After Moscow annexed Crimea in 2014, Russia experienced a crisis in supplying supplies to Europe through Ukraine, but unlike the interruption in 2009, this did not cause a real shortage.

How to bet on the energy market

China has announced a policy to reduce pollution by switching from coal to natural gas, especially for household heating, and imports of liquefied natural gas and natural gas through pipelines from Central Asia and Russia have also increased. In general, a world that was worried about the exhaustion of natural gas at the beginning of the 21st century, like oil, has become accustomed to taking abundant cheap natural gas as a natural fact. The main point of contention is not price or supply, but where natural gas should be in the necessary transition to low-carbon energy. Driven by the three factors of rising demand, supply disruption and the Kremlin, the complacency of this period may now be coming to an end.

In the early days of the Covid pandemic, natural gas was less severely hit than oil. Although the traffic ground stops, people still need to heat and ignite their home office and power their zoom calls. In April 2020, Asian LNG prices fell to a historical low of US$1.825 per million Btu. But by January 2021, oil prices have rebounded to a high of US$32.50 per barrel, which is about US$190 per barrel, which is higher than the price of crude oil.

In Asia, the use of liquefied natural gas to reduce pollution and solve domestic shortages is mainly the story of China. China may surpass Japan in 2021 and become the world's largest fuel buyer. Nevertheless, India, Pakistan, Bangladesh and Thailand are also important hotspots of new demand. The drought in Brazil is another climatic factor, which cuts the production of hydroelectric power and forced Brazil to run for LNG cargoes.

In the winter of 2020, severe cold pushed up prices, but Asian heat waves and air-conditioning demand have kept the market hot during the usually milder summer. Despite the rising cost of natural gas, the strong prices of coal and European carbon permits still maintain the attractiveness of natural gas.

Supply has been hit by a number of accidents and a shortage of approvals for new projects during the fallow period. The decline in U.S. shale oil production has also reduced the production of by-product-related natural gas, helping its Henhen Hub benchmark price to fall to $4.41 last Friday, which is much higher than the average of $2.65 since the oil price plunge in 2014. Norway’s Snowvet LNG plant will withdraw for a year and a half after a fire broke out in September 2021. Egypt, Algeria, Nigeria, Australia, Russia, and the United States have insufficient production due to various technical issues and maintenance delays related to the pandemic.

The key Groningen gas field in the Netherlands will be closed by 2023 due to continued earthquakes. As far as future supply is concerned, new LNG export plants in Canada and Mauritania-Senegal have been postponed due to the coronavirus, and the insurgency in Mozambique has stopped two large new projects, delaying them until after 2025.

There is also the most mysterious factor, Russia. Gazprom, the state-owned export monopoly, has cut supply to Europe, claiming that it needs to meet domestic demand and replenish stocks. Earlier in 2021, a fire broke out in its huge Ulengoi processing plant, which also led to a decline in production.

But some people suspect that Moscow has also deliberately delayed supplies to pressure Europe to force its nearly completed Beixi No. 2 oil pipeline. The United States and Germany reached an agreement in July 2021 to avoid sanctions on the project in exchange for stronger support for Ukraine.

Russian President Vladimir Putin warned Europe that after the contract expires in 2024, it must indicate how much gas Russia needs to send through Ukraine and that Kiev should show "goodwill" to keep the gas flowing. The decline in Russian exports means that Europe’s natural gas reserves are at their lowest point in a decade, when Europe’s natural gas reserves are usually prepared for the winter.

Relief is in progress. The LNG plant will be restored from maintenance, and if the weather is warm in October 2021, Europe can fill up its storage in time. Winters in the northern hemisphere of 2021-2022 and 2022-2023 are still vulnerable to supply constraints. If European and American coal can sustain and prevent Asian countries from further phasing out these dirty fuels, this is bad news for the climate.

Starting in the mid-2020s, natural gas from major LNG projects from the United States, Russia, Qatar, East Africa and Australia is expected to enter the market. The growth of competitive renewable energy sources will increasingly erode the power generation market, especially in Europe and perhaps the Middle East.

Keywords: new energy, overseas engineering, international engineering construction, foreign engineering construction news

Unless industries and power plants install carbon capture and storage systems, meeting climate goals will challenge the use of natural gas. However, the production of "blue" hydrogen and the electricity demand of electric vehicles may be sources of new demand. This is for the future. At present, the government and consumers' expectations of permanent abundant and cheap natural gas have been somewhat shaken. However, because long-term demand and competition are so clouded, only bold companies will invest heavily in new big investments.Editor/XuNing

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~