- As the heart of new energy vehicles, power electricity is becoming a new target of capital competition

- The power battery, which has been developed for more than 100 years, is becoming the most promising energy protagonist in this century

If the 19th century was the coal century and the 20th century was the oil century, then the 21st century is the super battery century. On May 31, 2021, CATL jumped into the “Trillion Club” with a market value, becoming the first company on the ChiNext with a market value exceeding one trillion. It only took more than 9 years for the CATL era to jump from a nobody to the world's largest power battery company. This company from Ningde City, a little-known prefecture-level city in Fujian Province, China, has confirmed a myth of the times about super batteries with personal experience.

With the continuous promotion of favorable policies for new energy vehicles in China, the advancement of related technologies, changes in consumer habits, and the improvement of supporting facilities, the rapid development of China's new energy vehicle market has led to the rapid development of the power battery market.

Competition of domestic and foreign lithium battery companies

In 2008, the Roadster sports car launched by Tesla in the United States pushed the battery into the era of rapid technological innovation. Tesla has thus become the first car manufacturer in the world to use only batteries in cars and commercialize them. "In the long run, the ultimate end of batteries should be lithium metal batteries," said Hu Qichao, founder and CEO of SES, a manufacturer of hybrid lithium metal batteries. Among the parts of pure electric vehicles, the power battery with the highest cost ratio has been raised to the C position on the stage, becoming the most dazzling star of this century. Because the new energy vehicle has a higher power capacity, the ordinary consumer battery cannot meet it, and the super power battery with larger electric energy, safer and more driving mileage has entered a period of rapid explosion.

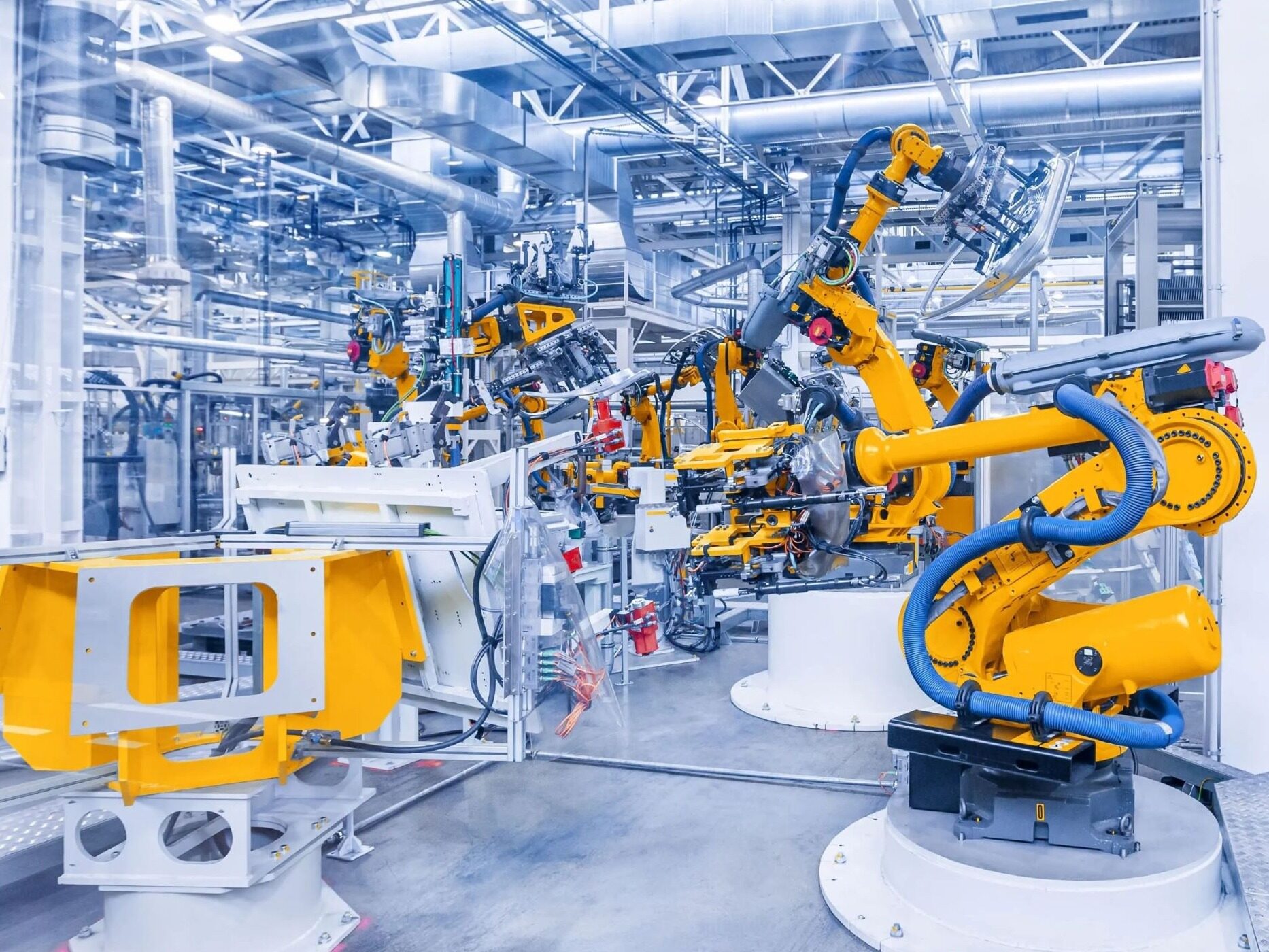

Tesla detonated the electric vehicle market, and the global power battery industry entered an explosive period. Starting from Tesla, China, Europe, Japan, South Korea, the United States and other major countries have vigorously developed global new energy vehicles under the background of the overall growth trend of global new energy vehicle sales. In 2020, under the influence of the new crown epidemic, the global sales of new energy vehicles still achieved a growth of 41.4%. The latest data from the China Association of Automotive Engineers shows that in July 2021, China's new energy vehicle production and sales reached 284,000 and 271,000, respectively, an increase of 1.7 times and 1.6 times year-on-year. According to the "New Energy Vehicle Industry Development Plan (2021-2035)", by 2025, China's new energy vehicle sales will account for 20% of the total sales, and by 2035, pure electric vehicles will become the mainstream model for new car sales. Xie Tian, Managing Director of Boston Consulting Group (BCG), global partner, and core executive in China in the automotive and mobility business field, believes that for mainstream car companies, if they want to reach the carbon peak and carbon neutrality at the critical time node Emission reduction targets, we must increase investment in production and sales of more new energy vehicles.

Cui Dongshu, secretary general of the Passenger Vehicle Market Information Joint Committee of the China Automobile Dealers Association, said: "The development of CATL in the past ten years has benefited from the high prosperity track where it is located. The intersection of the three major industrial fields is an industry that is as important as new energy vehicles."

Global new energy vehicles are growing rapidly, with sales increasing nearly 11 times in the past six years. The EU's carbon emissions are becoming more stringent, and the new electric models of the world's mainstream car companies will usher in a launch cycle from 2020 to 2022. The domestic double-point policy is expected to underpin the sales of passenger cars, superimposed on the increase of domestic Tesla and joint venture car companies, and the industry is expected to continue to grow rapidly from 2020, and the global power battery industry is about to explode. Benefiting from the development of new energy vehicles, global power battery shipments have increased by nearly 9 times in the past five years. From the perspective of competition, the power battery industry is concentrated in China, Japan and South Korea. In 2019, the industry CR10 reached 87%, and CR5 reached 87%. 75%, and the industry concentration has increased significantly.

Grab the power battery

Looking at the world, the power battery field has formed a "three-legged" pattern between China, Japan and South Korea, and the "Matthew effect" is prominent. Under the current technological pattern, how many opportunities are there for latecomers? The "heart" of new energy vehicles, the power battery, is becoming a new target for capital competition.

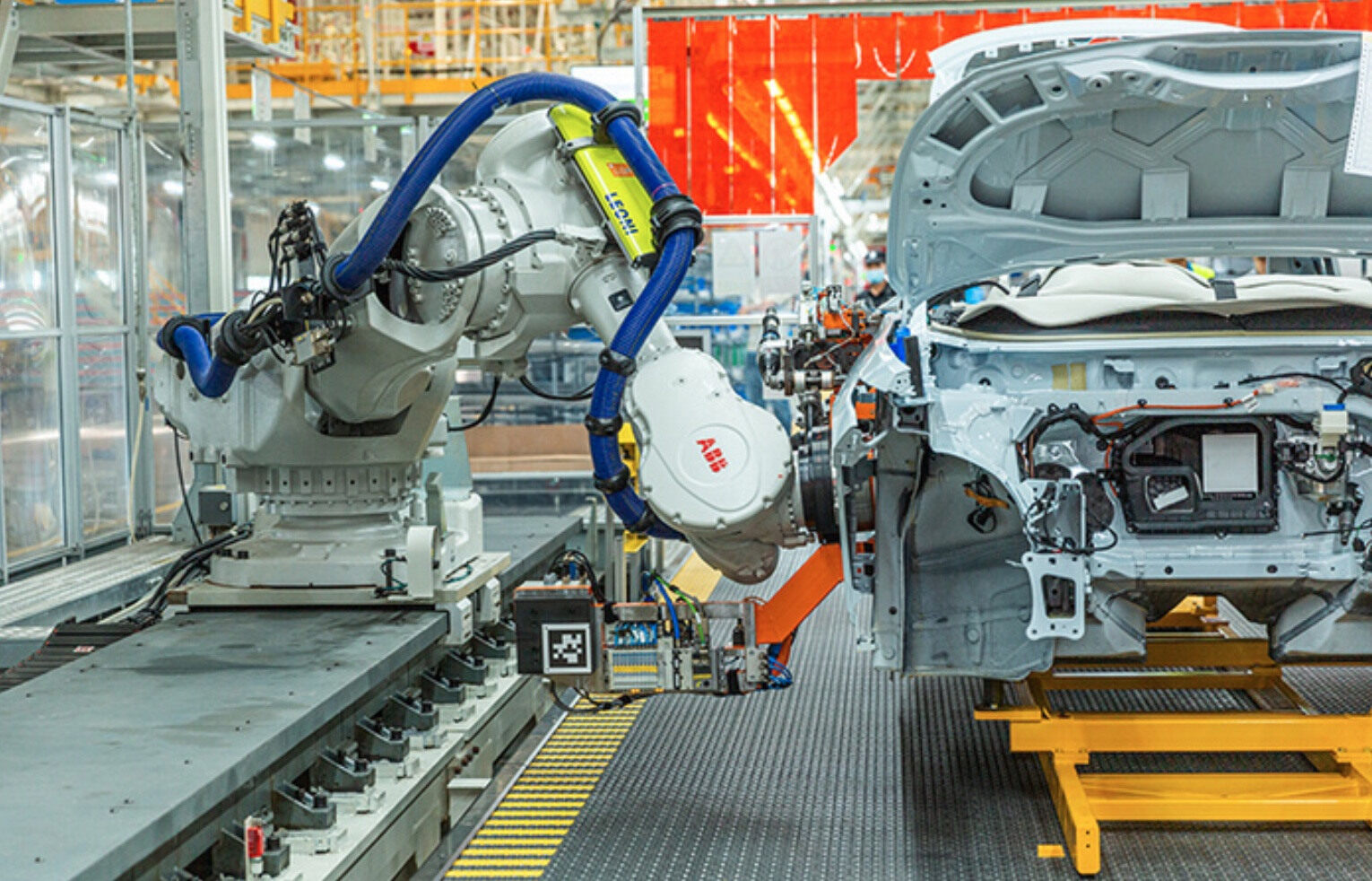

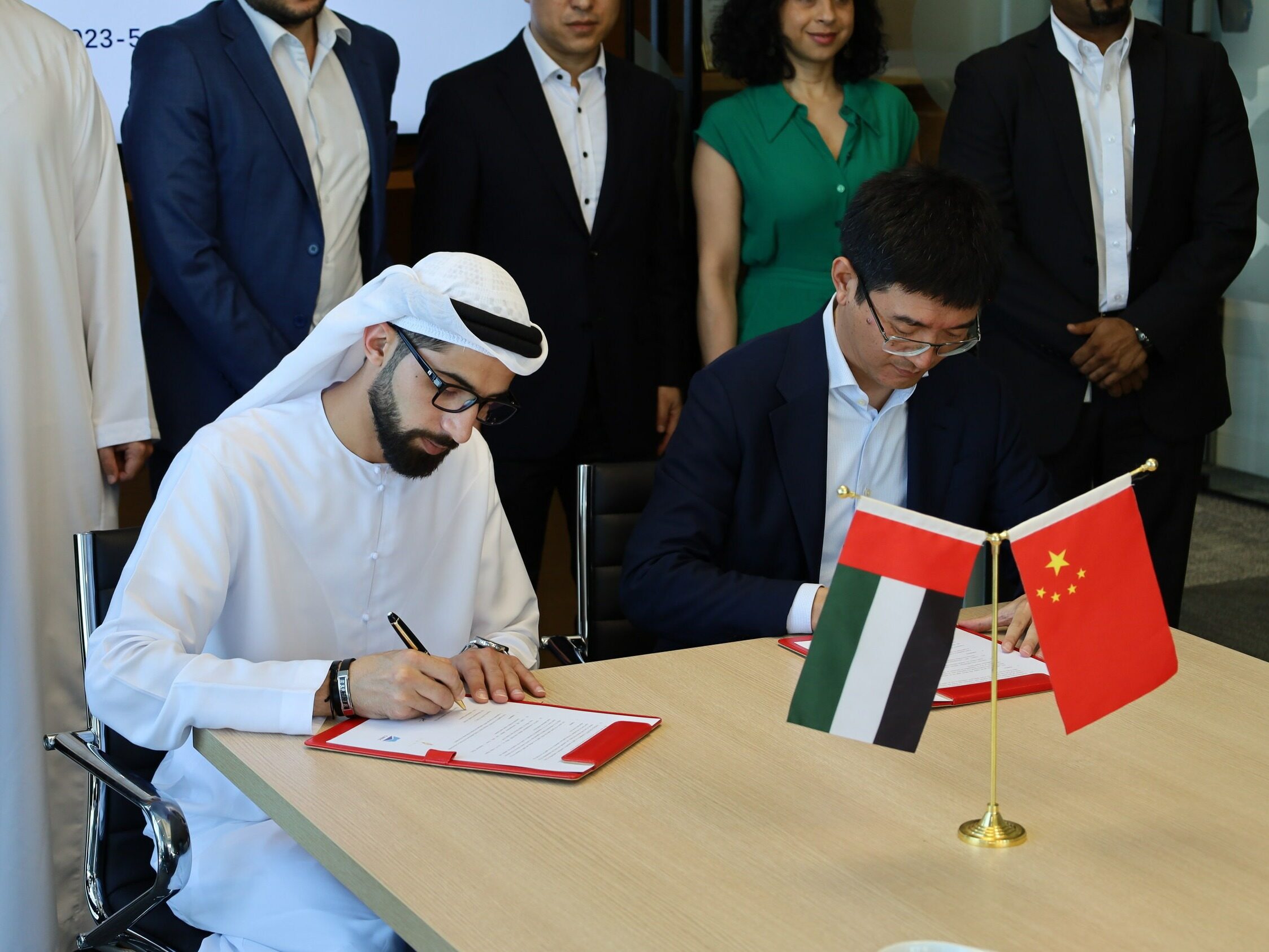

Traditional OEM giants, new energy vehicle companies and investment institutions have invested heavily in the field of power batteries, including Volkswagen, BMW, Honda and Mercedes-Benz, in order to solve the supply chain security problems of power batteries and gain an advantage in the future auto industry. Daimler and other large multinational car companies have also set their sights on China, the world's largest new energy vehicle market.

The prospect of power batteries is attractive. At the same time, countries such as Germany are also increasing their investment in power batteries. "In the long run, there may be more metals in the future, but in the short term, it is difficult for the technology of power batteries to make greater breakthroughs, and lithium-ion batteries will still be in the mainstream position in power batteries." Li Ke, a partner at Boston Consulting Group, said. A "battle" in the power battery market is starting with a high profile.

Both multinational car companies and investment institutions have shown unprecedented interest in power batteries, especially in the Chinese market.

"The current competitive landscape in the power battery field is not completely solidified. Even leading companies need to continue to innovate and invest heavily to continuously optimize their products to face the challenges brought about by market changes, technological innovation and more intense competition." Boston Consulting Group Global partner Xie Tian said. Since 2021, German and Japanese multinational car companies have competed for equity in Chinese power battery companies, and discussions have been booming. It is observed that multinational car companies have more or less achieved "marriage" with Chinese power battery companies, and the relationship between OEMs and power battery suppliers is moving from a simple buying and selling relationship to a deep binding of capital investment. relation. The power battery competition is turning white-hot.

The European power battery army is about to attack

The capital layout is frequent, and the competition in the power battery industry is also more intense. Data show that as of July 2020, there were nearly 13,000 power battery-related companies in my country. In 2016, the growth rate was the fastest, with 1,865 new registrations throughout the year, an increase of 81.95% year-on-year. In 2018 and 2019, there were nearly 3,000 new registrations. “Europe is going to see a huge increase in electric vehicle demand, so now is the time to build factories,” said Mitari Gupta, an energy storage analyst at Wood Mackenzie in Boston. Disruption has made automakers more willing to find key suppliers nearby.

With the help of capital, CATL, BYD, Guoxuan Hi-Tech and Yiwei Lithium Energy are still seeking to expand their production capacity. However, against the background of the current decline in sales of new energy vehicles and installed capacity of power batteries, will the continuous large-scale investment of capital cause the risk of overcapacity in the domestic power battery industry?

Although there may be some tension in the structure, in fact, the production capacity of power batteries has always been surplus in general. However, any growing sunrise industry actually has a certain overcapacity, and the overcapacity of power batteries is maintained within a certain range. Because the power battery production equipment has been updated very quickly in recent years, the equipment invested three or four years ago may basically have little value. So if the battery factory goes bankrupt, the older production capacity actually disappears, because no one is going to undertake it, and everyone is more willing to see some newer production capacity. The reason why leading manufacturers such as CATL and BYD are still expanding production is because they are always ready to take over market orders from those small and medium-sized battery factories that have closed down.

From the perspective of market share distribution, at present, the share of China's power battery industry is heavily skewed towards leading companies such as CATL and BYD, and the Matthew effect is already very obvious.

According to data, in the first half of 2020, the top 10 companies with installed capacity accounted for 93.77% of the market share of power batteries. CATL accounted for nearly half, reaching 48.31%; BYD accounted for 14.01%; after the cancellation of the "white list" of power batteries, foreign brands LG Chem and Panasonic made a comeback, occupying 9.53% and 6.71% of the market respectively; the remaining less than 30% It will be divided up by AVIC Lithium Power, Guoxuan Hi-Tech and other companies. If overseas battery manufacturers are not considered, domestic power battery companies have basically formed three echelons.

The first echelon is CATL and BYD. From 2016 to the present, they have basically stabilized in the top two positions, and already have a relatively monopoly position. If BYD's external battery supply can go well, the market share will increase significantly. The second tier is the 3rd to 10th tier manufacturers. These 8 positions are very unstable. A total of 19 battery factories have stayed there. It is expected that the second tier manufacturers should continue to survive in the market after 5 years. The third echelon, the manufacturers outside the 10th place, is shrinking rapidly. The reshuffle of the power battery industry has already begun. According to the data, from 2016 to 2019 and the first half of 2020, the number of domestic power battery manufacturers was 126, 92, 88, 72 and 58 respectively, decreasing year by year.

Judging from the current domestic power battery investment trend, most of the funds are concentrated in leading companies, which may further stimulate the industry to reshuffle.

From a global perspective, even China's leading power battery companies such as CATL still face the risk of reshuffle. From 2017 to 2019, CATL has always had the largest market share in the global power battery industry, but since the first quarter of 2021, its leader position has been replaced by LG Chem.

According to SNEResearch data, in the first half of 2020, the global installed capacity of electric vehicle power batteries fell by 23% year-on-year to 42.6GWh, but LG Chem’s installed capacity increased against the trend, with a market share of 24.6%, ranking first in the world, and CATL has a market share of 24.6%. The rate was 23.5%, ranking second.

Who is the "fourth pole"? Behind the change of seats in the CATL era and LG Chem is that the new energy vehicle market is changing, and Europe is becoming a new battlefield. In addition to the current situation where the power battery market is dominated by China, Japan and South Korea, new forces from Europe are constantly rising. Regarding the transformation of the global power battery pattern, Zeng Yuqun, the founder of CATL, once gave an impressive summary, "The Americans invented lithium batteries, the Japanese commercialized them, the Koreans made them bigger, and the Chinese made them the best. Cheap and available to the world.”

Recently, French battery manufacturer Verkor announced that it will open and operate a lithium battery production plant with an annual output of 16GWh in France in 2023, and expand its annual output to 50GWh according to market development. It is reported that the batteries produced by Verkor will be used in electric vehicles (EV) and stationary energy storage.

This is not the only news about European power battery companies in the near future. In addition to the current situation where the power battery market is dominated by China, Japan and South Korea, new forces from Europe are rising. Active layout.

Meet the new era

The global battery technology market is driven by increasing use of electric and hybrid vehicles, growing global interest in consumer electronics, and stricter government regulation of emissions. The 2020 market is estimated at just over $90 billion. It is expected to grow at a compound annual growth rate of around 10%, reaching over $150 billion in just 5 years. Lithium-ion batteries will have the greatest impact on growth due to their wide range of applications and further development potential.

China, which has lost its first-mover advantage in the era of fuel vehicles, is achieving "curve overtaking" through new energy vehicles and power batteries. A complete, efficient and large-scale supply chain, a huge consumer market, the government's thirst for energy security, and strong support for the new energy industry have given China an absolute competitive advantage in the field of new energy vehicles. BYD's leading position in the field of power batteries.

"The power battery industry has rapidly entered the "Post-Warring States Era" from the 'Spring and Autumn Era', and has gradually formed a new pattern of strong alliances and oligarchic divisions between vehicle companies and backbone power battery companies. "Liu Yanlong, Secretary General of China Chemical and Physical Power Industry Association, pointed out. , from the current industry pattern, it can be inferred that in the future, most of the production capacity of the new energy vehicle and power battery industry will be concentrated in a few large companies, but the competition has just begun.

Looking forward to the future, in the global market, LG will occupy the high-end market with its understanding of material systems and high-quality products, while CATL will occupy the mid-to-low-end market with its cost advantages, and is expected to expand its high-end market share after gradually accumulating technology. . We believe that the industry's top 4+ BYD pattern will be stable in the next few years, mainly due to the long cycle of complete commercialization of new technologies, the comprehensive advantages of current leading companies in terms of cost and technology, and the long certification cycle for downstream customers. The reason is that small businesses and companies using new technologies will face many challenges if they want to enter the industry head.

For the lithium battery industry, it will take at least 10 years for new technologies to leap from the laboratory stage to full commercialization. Safety is a key indicator for downstream OEM manufacturers to choose battery suppliers. At present, companies including Panasonic and LGChem have been deeply involved in the lithium battery industry for many years, and their products have won the trust of downstream customers in terms of safety and other performance.

It is estimated that by 2023, the production capacity of the current top companies in the industry will reach 100GWh. According to industry experience, a 2-3 times increase in production capacity may reduce manufacturing costs by about 6-18%; Begin to start a strategic layout in the upstream metal resources field, especially in the lithium metal field. With the long-term cooperation with upstream resource companies, we believe that the current leading companies will have more significant cost advantages in the upstream material sector in the future. At the same time, similar to integrated circuits, the power battery industry is also a capital-intensive industry. To achieve a production scale of 100GWh, it requires an investment of more than 20 billion euros. The huge capital expenditure is expected to hinder the entry of companies like Bosch with strong technical accumulation in the industrial field. Therefore, the cost advantage of leading enterprises will be more obvious in the future, and the industry concentration is expected to be further improved. Therefore, we predict that the market share of CATL, LG, Panasonic, and Samsung SDI is expected to increase to 68% in 2022, and to 71% in 2025.

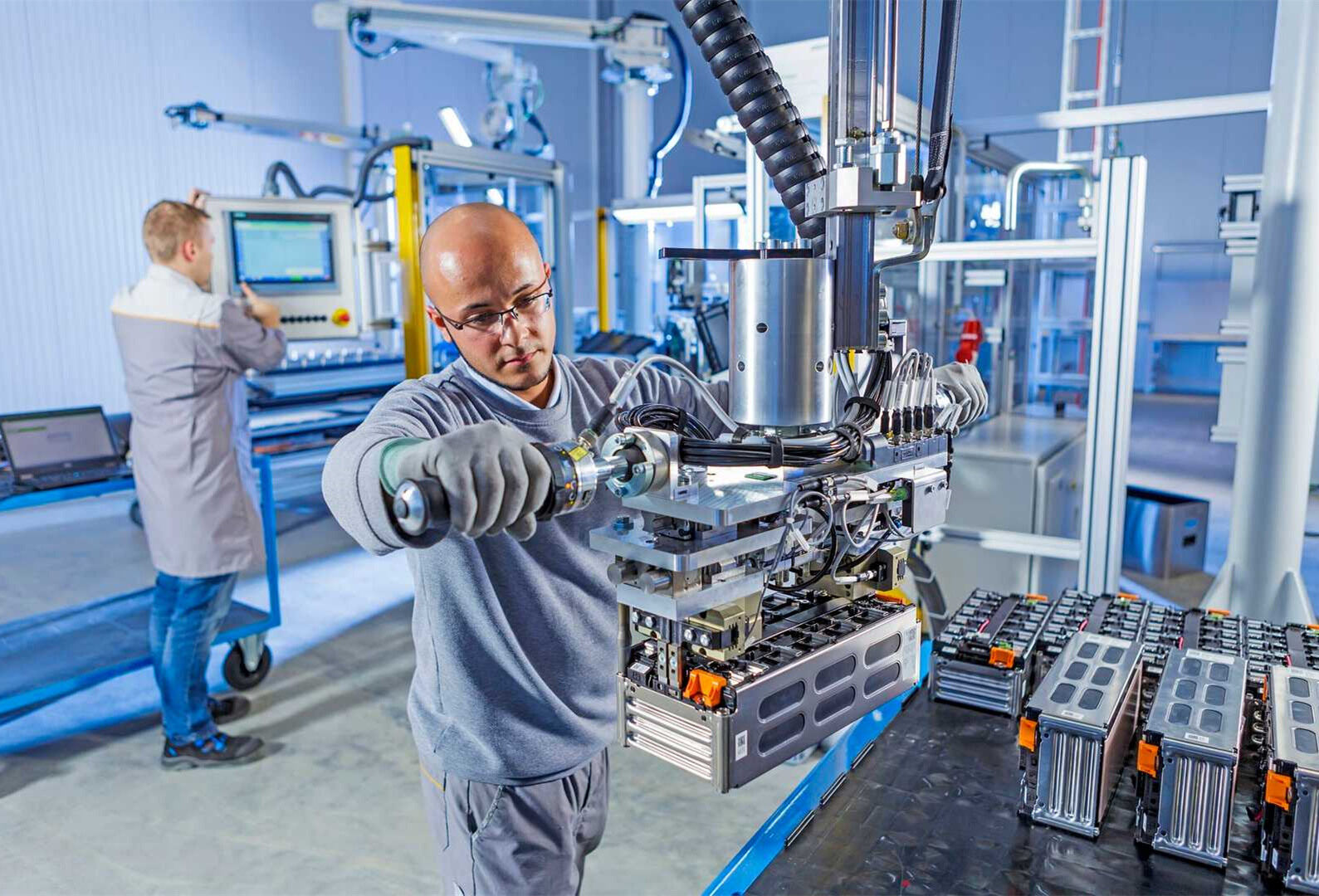

At present, China's production capacity does not lag behind other countries, but how to establish high-quality production capacity and make these production capacity more reasonable is a problem that enterprises need to consider. On the basis of ensuring quality, power batteries already have the basis for large-scale commercialization, and in order to cope with large-scale commercialization development and the surge in market demand, although they should not blindly expand, manufacturers should also prepare capacity reserves.

The power battery as the "heart" determines the development level of new energy vehicles to a certain extent. It can be said that whoever masters the most hard-core power battery technology and supply will control the pricing power and initiative. The seats of OEMs in the future auto industry will also be determined by the chips they cast now. Editor/Sang Xiaomei

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~