- Battery swap brings a systemic change to new energy vehicles, and the addition of Ningde era has pressed the accelerator for this change

In recent years, with the rise of new energy power batteries represented by lithium iron phosphate and ternary lithium, the status of "industrial blood" oil has gradually declined, and a "snatch war" about new scarce resources has quietly started. In addition to lithium and nickel, there is another scarce resource, and China's reserves are only 1%! So this time, will we be "stuck in the neck" again?

New favorite of strategic resources - cobalt

2021 can be described as the first year of new energy vehicles, with global sales of new energy passenger vehicles reaching nearly 6.5 million, a year-on-year increase of 108%. BYD's sales of new energy vehicles in one year alone reached nearly 600,000, while the global leader in new energy vehicles, Tesla, sold more than 900,000 vehicles.

With the surge in sales of new energy vehicles, the rapid consumption of power battery raw materials has come. At present, there are three main types of resources consumed by mainstream power batteries in the world: lithium, nickel and cobalt. China's foreign dependence on these three metals is very high, reaching 79%, 92%, and 97% respectively. In particular, cobalt ore can be said to be almost dependent on foreign imports, and cobalt ore is dubbed "cobalt grandma" by the industry. Therefore, in recent years, it has become an open secret that Chinese companies such as CATL and Ganfeng Lithium have “snatched” cobalt ore overseas.

According to USGS data in the United States, the cobalt content in the earth's crust is 0.001%, and the cobalt resources in the ocean are relatively large, about 2.3 billion tons. The proven cobalt resources on land are only 25 million tons. And 90% of the cobalt in the crust is in a dispersed state, or exists in the form of associated minerals. For example, it is mostly associated with copper, nickel, iron and other minerals, and there is basically no independent output.

Many people will think that reserves in units of "10,000 tons" are still scarce? We can make an analogy. At present, the proven oil reserves in the world are 244.6 billion tons, which is nearly 10,000 times that of the proven cobalt. Not to mention a scarce resource like cobalt. Coupled with the huge demand for lithium batteries in new energy vehicles today, the strategic significance of cobalt resources is highlighted.

According to the Mining.com website, the latest research report by the country risk and industry research team of Fitch Solutions, an international financial risk insight, response and management consulting firm, believes that, driven by the transformation of the global green economy, in the next 2 to 3 years , the global cobalt industry will still face great development opportunities, and cobalt prices will rise.

This metal is a key material for rechargeable batteries, valued for its stability, hardness, corrosion resistance and high temperature resistance.

Historically used as a pigment due to its vivid blue color, cobalt is currently used primarily as a precursor and cathode material for rechargeable batteries, accounting for 56% of total cobalt consumption in 2021.

Cobalt is also used in the production of nickel-based alloys (13% of total consumption), which are widely used in the aviation industry, tool making (8% of total consumption), and in small amounts in pigments, soaps and catalysts.

The end-use of cobalt is mainly in portable electronics (36.3% of global consumption), such as smartphones and laptops, with a significant share in the automotive industry (23%).

"We expect the latter to drive cobalt consumption growth over the next few decades," Fitch Solutions said.

So, as the lithium battery industry consumes the most cobalt, what effect does cobalt have on lithium batteries?

In the field of power batteries, cobalt is mainly used to prepare the cathode material of lithium-ion batteries, and the addition of cobalt can greatly improve the stability and safety of lithium-ion batteries. Since cobalt improves the cycle performance of lithium batteries, the life of lithium batteries will also be greatly improved. The lithium element is highly active, and the role of charging in the power battery is like a monkey who just jumped out of a stone. However, without the restraint of cobalt, the "tightening spell", it is difficult to pass the safety test of the power battery such as the acupuncture test.

Since the status of cobalt is so important, how many opportunities do Chinese companies have in the new round of energy competition?

The hometown of cobalt - Congo

Cobalt is primarily recovered as a by-product of copper and nickel mining, and its availability depends on continued mining of its host metal. At present, copper-cobalt ore and polymetallic deposits semi-grown cobalt account for about 73% of cobalt resources, mainly in the Democratic Republic of the Congo (DRC) and Zambia, which are the largest sources of cobalt in the world, followed by nickel-cobalt laterite deposits, mainly found in Australia, Cuba, New Caledonia, Madagascar, Papua New Guinea and the Philippines.

The reserves and production of cobalt resources are highly concentrated geographically. According to data from the US Geological Survey in 2019, Congo (DRC) is the country with the largest reserves of cobalt ore resources in the world, accounting for about 52%, and the DRC is also the largest in the world. cobalt producing countries. In 2018, the global cobalt mine production reached 135,700 tons, while the Congo in Africa topped the list with 90,000 tons of output. In 2020, Congo (DRC) alone accounted for 67% of global supply.

From the perspective of global cobalt producers, cobalt is also a highly "monopolized" resource.

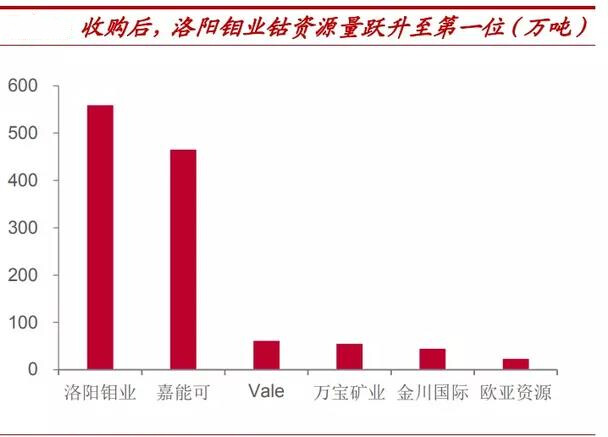

In recent years, through the acquisition of the Tenke and Kisanfu copper-cobalt projects in Congo (DRC), CMOC has continuously increased its cobalt resource reserves. Especially at the end of 2020, through the acquisition of the Kisanfu copper-cobalt project in Freeport, CMOC controlled the cobalt resources from 248.73%. 10,000 tons increased to 5.5873 million tons, doubling the amount of cobalt resources. At the same time, the amount of cobalt resources also successfully surpassed Glencore (4.6508 million tons of cobalt resources) to become the world's largest cobalt resource company.

Looking at the world, important cobalt mining companies are controlled by Swiss and Chinese companies such as Glencore, China Molybdenum Industry, Jinchuan Group and so on. Among them, the cobalt resources owned by CMOC and Glencore account for nearly 40% of the global cobalt resources.

In terms of output, the annual output of Glencore's cobalt mine in 2020 is about 35,000 tons, accounting for about 25% of global output, and has a decisive influence on global cobalt supply. China Molybdenum's annual cobalt output in 2020 is 15,400 tons, accounting for about 11% of the global total, and the two companies together account for 36% of the global total.

In 2022, Glencore plans to restart the operation of the world's largest cobalt mine, Mutanda Cobalt Mine. China Molybdenum Industry Co., Ltd. has reached production capacity with projects such as TFM's multiplication project, Kisanfu's new project and NPM's new ore body development. It will also usher in an outbreak period.

According to reports, after China Molybdenum spent 17.2 billion to acquire the largest cobalt mine in Congo in 2021, four Chinese companies have entered the top 10 cobalt mine production. However, looking at the "cobalt circle", I did not see the "battery bigwig" Ningde era getting a first-hand mine source. At the end of 2021, CATL offered to acquire Canada’s Millennium Lithium with a price of US$297 million, but was “cut off” by Lithium Americas for US$400 million. The last piece of the "cobalt battle", the Ningde era still failed to catch up.

As the world's largest power battery manufacturer, CATL, which cannot obtain cobalt ore, will eventually be controlled by others in the future industrial chain layout. In order to break the shackles, CATL is determined to enter the field of secondary utilization of power batteries.

Ningde era launches battery swap track

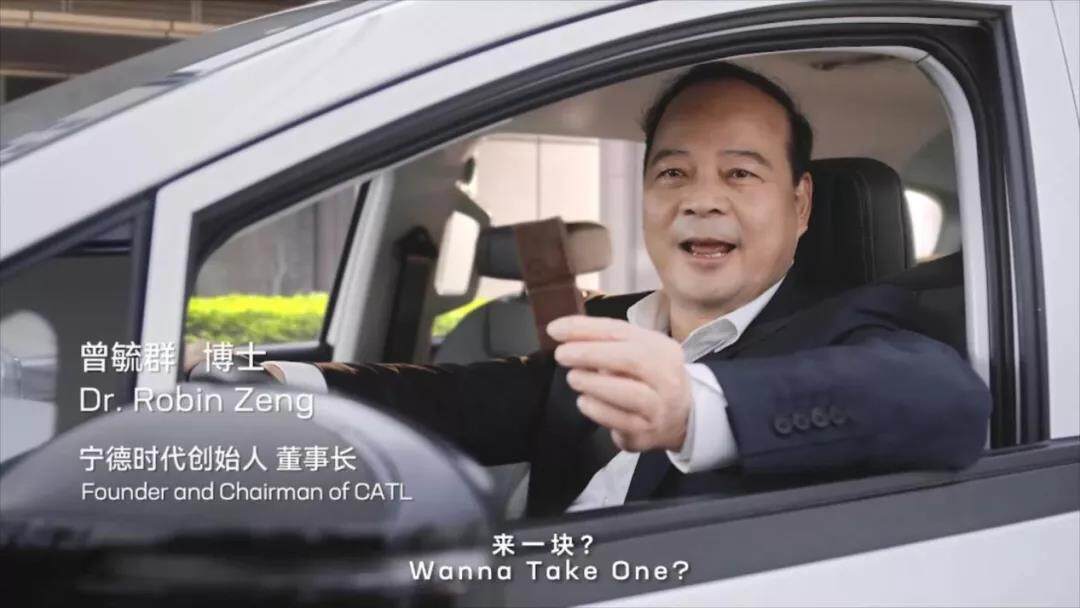

On January 18, CATL, with a market value of one trillion yuan, announced its entry into electric vehicle battery swaps, and its wholly-owned subsidiary released the battery swap service brand EVOGO (Lexing Battery Swap), providing an overall solution for combined battery swaps, including "battery swaps, Quick change station, APP" three products. So far, the Ningde era has officially entered the power exchange track.

If cobalt is added to the lithium battery, the safety problem of the lithium battery is solved from the inside. Then battery replacement provides an external solution for the safety of lithium batteries. EVOGO is a power exchange brand developed by CATL in order to realize "shared power exchange". The BMS technology it carries has greatly improved the safety of the plug-in parts of new energy vehicles.

Not only that, the battery swap brings a systemic change to new energy vehicles. Among them, the addition of the Ningde era has pressed the accelerator for this change.

What's so special about Ning Wang's power exchange? In the field of power exchange, the Ningde era is not a pioneer. Many companies have tried it before. For now, the most well-known one is Weilai's power exchange. In NIO's entire service system, the battery swap service has become a symbolic element that differentiates it from other new energy brands. If the Ningde era just follows the pace of NIO, then this power exchange market may not be as good as NIO. Fortunately, the Ningde era has a different identity.

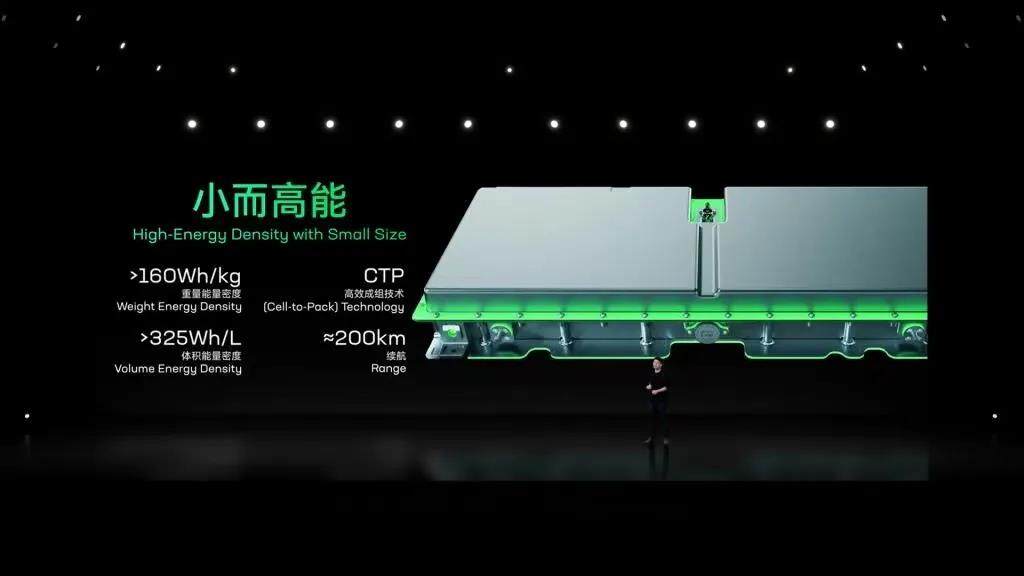

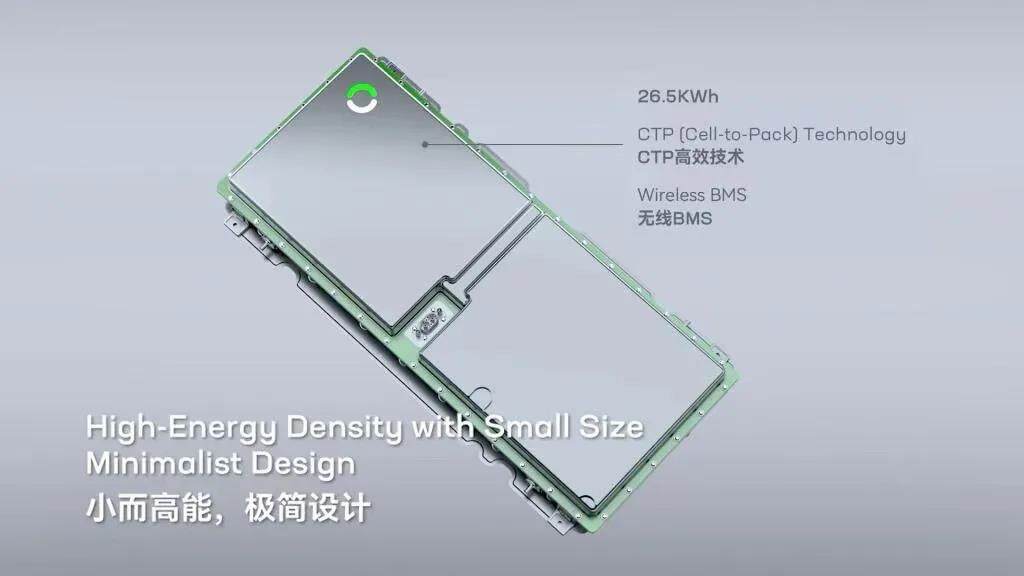

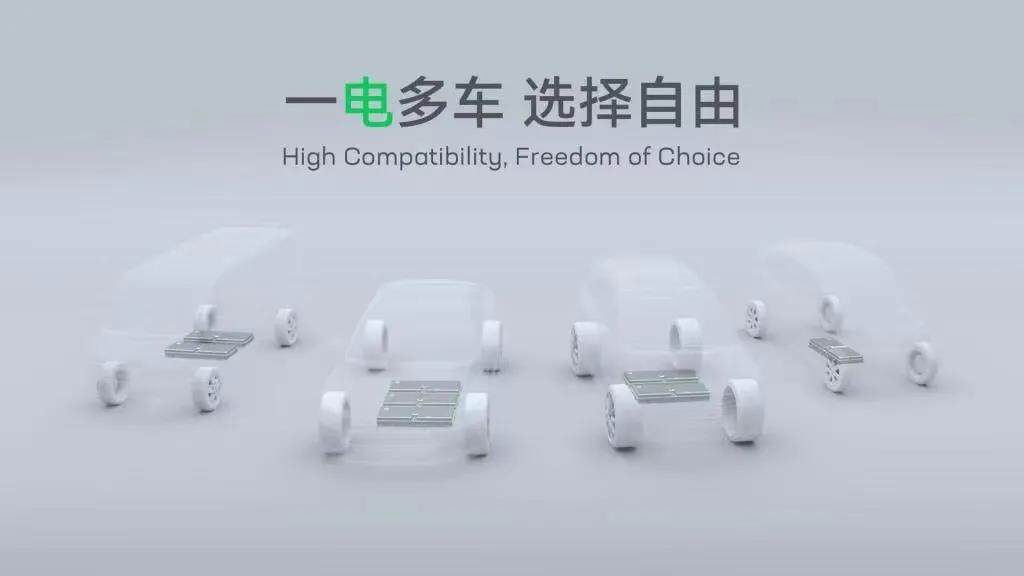

As the largest power battery supplier in China and even in the world, CATL has enough market share and holds a lot of right to speak. As we all know, the battery pack size specifications of each car company are different. If the battery replacement service that can be widely used is to be implemented, the problem of battery pack size specifications must be solved. CATL has developed a "chocolate battery swap block" for this purpose, which has a unified size standard. One or more battery combinations can be selected according to the model and needs to flexibly match the needs of different mileages.

This "chocolate power exchange block" adopts the latest CTP technology, the weight energy density exceeds 160Wh/kg, the volume energy density exceeds 325Wh/L, and a single battery can provide a battery life of about 200 kilometers. In addition, the "chocolate power exchange block" also uses wireless BMS technology, which saves a lot of wiring harnesses. There are only high-voltage positive and negative interfaces on the outside, which greatly improves the reliability of pluggable components.

After solving the battery size problem, CATL still needs to solve the problem of model adaptation. According to the information released by CATL, this "chocolate power exchange block" can be adapted to 80% of the world's pure electric platform development that has already been launched and will be launched in the next 3 years. 's model. This means that existing electric vehicles can also be adapted to the battery swap mode. Car companies adopt the Ningde era battery swap solution without making too many changes in vehicle manufacturing, without adjusting the chassis, and only need to develop a replacement for the chocolate battery. Electric stand. According to the vision of CATL, the "chocolate power exchange block" can be applied to miniature to medium-sized passenger cars and logistics vehicles, and the power exchange station can be adapted to various brands of models, breaking through the adaptation barriers between batteries and models, and realizing power exchange models cover.

In terms of operation mode, Ningde Times proposes that consumers can "rent electricity on demand", and freely choose the number of leased replacement blocks according to their own usage scenarios and habits. From the perspective of CATL, most private car owners currently only use 10-20% of the battery power in daily use scenarios, but in order to relieve mileage anxiety and energy replenishment anxiety, they have to buy models with large power and pay a lot of money battery cost. Through "rental electricity on demand", consumers only need to rent an electricity block for daily commuting in the city. If you want to travel for a long distance, you can choose two or three power blocks, so that you can increase or decrease the power consumption freely. From a conceptual point of view, Ningde era has given solutions in terms of adapting models and battery usage costs, and it seems feasible.

In terms of power exchange stations, the power exchange stations of the Ningde era are similar to the mainstream power exchange stations on the market. Each of its standard stations covers an area of three parking spaces. It takes about 1 minute to exchange electricity for a single power block, and 48 exchange stations can be stored in the station. Electric block, which is much more than the 13 batteries of the current Weilai second-generation power exchange station.

As a battery giant, it is difficult to judge whether Ningde era can change user behavior patterns and promote the power exchange market to become bigger and stronger, but the difference is that the chips in Ningde era are unmatched by other opponents, and the most important Yes, the Chinese auto market is large enough, there are enough demands, and there are enough application scenarios, so it also provides enough verification opportunities for business model innovation.

This makes Ningde Times believe that even if it cannot achieve a dominant market appeal through exclusive products and advanced manufacturing processes like Bosch or TSMC, it can rely on relatively advanced technology and in-depth supply chain management, with the combined force formed by industrial clusters to maintain Its own leading position and suppress rivals including LG New Energy - this includes not only binding car companies, but also binding users through the business model innovation of battery swapping.

Today, the global battle for scarce resources has begun. Even if the previous "trillion" giants as powerful as the Ningde era, without the support of upstream scarce resources, will face a situation of forced transformation. Or improve the technology to realize the research and development of "cobalt-free batteries"; or change the track, such as entering the field of power exchange, or the recycling of power batteries for secondary use.

However, although the Ningde era does not have an advantage in cobalt mines, it is fortunate that at the national level, China still has a first-mover advantage in the global layout of cobalt mines. At present, nearly 80% of the world's refined cobalt is Made in China. I believe that in this "resource competition", we will not be "stuck in the neck" again. Editor/Sang Xiaomei

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~