- Infrastructure REITs have a significant effect on expanding effective investment and reducing government debt risks

On May 16, 2022, the executive meeting of the State Council of China proposed new requirements to encourage the issuance of infrastructure REITs. It marks the complete success of the pilot work of China's infrastructure REITs, entering a new stage of "encouraging issuance" and "revitalizing infrastructure and other stock assets".

The development of China's REITs has entered a new stage

The executive meeting of the State Council pointed out: "The meeting requires the revitalization of infrastructure and other stock assets, which is conducive to broadening social investment channels, expanding effective investment, and reducing government debt risks. First, we must encourage the implementation of revitalization through the issuance of real estate investment trust funds. Demonstration of attractive projects, and treat all market entities involved in investment equally. Second, we must improve the market-oriented operation mechanism and increase the level of project income. Special debts can be used to support the investment of recovered funds into new projects. Third, we must adhere to the principle of marketization and the rule of law. , determine the transaction price openly and transparently. Ensure the stable operation of infrastructure and protect the public interest.”

The above meeting communique, the content is concise and comprehensive, the requirements are quite clear.

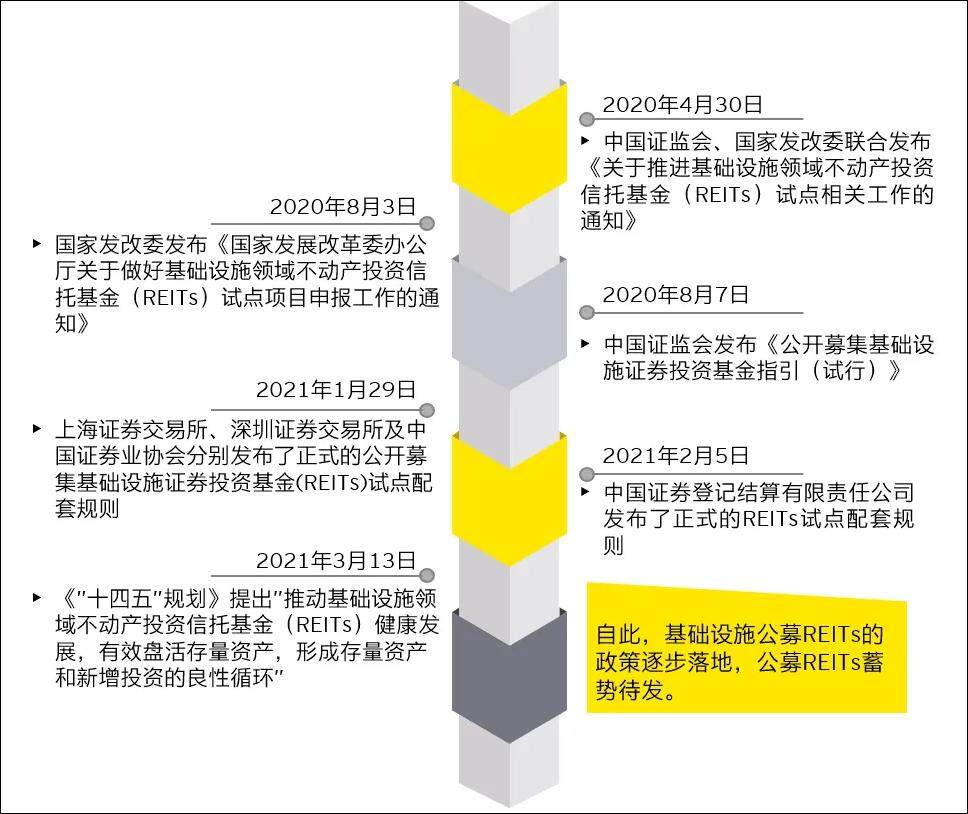

Previously, the State Council had repeatedly put forward requirements for "promoting REITs pilot work", and the competent authorities had also issued relevant documents in accordance with the requirements of the State Council. Starting from 2020, the "Infrastructure REITs Pilot" jointly launched by the China Securities Regulatory Commission and the National Development and Reform Commission has achieved a complete success in two years and has become a new sector that is well received by stable investors and enthusiastically accepted by China's capital market. Practice has shown that the introduction of this innovative financial product into China has a significant effect and significance in revitalizing existing assets such as infrastructure, broadening social investment channels, expanding effective investment, and reducing government debt risks. Great potential.

The reporter has been making unremitting suggestions since 2005 to introduce internationally popular real estate asset securitization REITs products into China, which has lasted for 17 years. Glad that my proposal has finally been accepted in recent years and has been successfully piloted in the infrastructure field. The practice of REITs in China has proved that this innovative financial product is very suitable for China's national conditions, and will play a greater role in the healthy and sustainable development of China's economy and the formation of a virtuous circle.

The State Council's new requirements will comprehensively guide the issuance and operation of REITs

The new requirements put forward by the State Council have absorbed the experience of the previous phase of the infrastructure REITs pilot, in the recommendation and issuance of REITs, the selection and determination of REITs assets, the main body of REITs implementation, the direction of investment encouragement, and the management and operation of REITs after listing. Important requirements and guidance were put forward.

First, put forward requirements to encourage the issuance of REITs. In the requirement of "revitalizing infrastructure and other stock assets", the State Council clearly proposed "encouraging the implementation of revitalization through the issuance of real estate investment trust funds". REITs are a form of direct financing. The various infrastructure financing methods that China used to use before, including bank loans, loans from other financial institutions, BOT, PPP, issuance of debt funds, etc., are indirect financing methods, and project funds are debt funds. The issuance of real estate investment trust fund REITs is conducive to the conversion of kinetic energy, the long-term operation of the project, and the reduction of rigid payment; REITs process real estate assets into holding shares, making social funds easy to hold; REITs have annual dividends according to their shares. Income, these shares also have the convenience of entering the capital market circulation. It can be seen that REITs are a significant financial innovation.

Second, clarify the importance of issuing REITs. Including: "reduce the risk of government debt" and "conducive to broadening social investment channels and expanding effective investment". As mentioned above, while China's infrastructure construction has achieved great results, it has also allowed local governments to accumulate huge debts of tens of trillions of yuan. At present, many local governments have difficulty in repaying interest and have no hope of repaying the principal. They can only rely on borrowing new to repay the old to delay repayment. The high debt ratio hinders the investment ability of local governments and enterprises. However, many of the real estate assets formed by the investment have been put into normal operation, and the income such as rent is in good condition and has a stable yield. Some of these high-quality assets are processed into REITs products, which are separately held by social funds, which is conducive to expanding effective investment and resolving local debts; at the same time, it broadens the channels for social investment, and delivers capital goods with stable returns to the society; enter the stock market circulation transaction , and enrich and activate the capital market.

Third, put forward requirements for the main body of REITs. The new requirements of the State Council include: 1. "Guide local governments to present attractive project demonstrations", which requires local governments to provide stable and operational projects with good returns, and do not try to use projects with poor returns or projects that have not yet reached the return period. Report the issuance of REITs. 2. It is required that "all market entities participating in investment should be treated equally", which is aimed at people's doubts that "REITs approval only supports state-owned assets, not private assets", and also proposes to the competent authorities that "all types of investment entities should be treated equally". requirements. 3. "Special bonds can support the investment of recovered funds into new projects", which is an encouragement direction for REITs issuers according to the country's needs to expand infrastructure investment. It does not mean that after issuing REITs to obtain funds, local governments cannot use it to repay debts.

Fourth, put forward requirements for the operation of REITs. The new requirements of the State Council also include: 1. "Adhere to the principle of marketization and rule of law, and determine the transaction price openly and transparently", which requires REITs to enter the capital market in a regulated manner; The stable operation of infrastructure and the protection of public interests”, which requires that after the establishment of REITs, it is necessary to ensure that infrastructure projects continue to operate steadily, and strive to improve the level of project income, so as to maintain the capital rights and interests of REITs investors.

Starting REITs from infrastructure projects is the path to success

Regarding the issuance of "Real Estate Investment Trust Fund" or translated as "Real Estate Investment Trust Fund" in China, the "Government Work Report" in March 2016 proposed "exploring the securitization of infrastructure and other assets", and the "Thirteenth Five-Year Plan Outline" proposed "Real Estate Investment Trust Pilot Project". In recent years, the State Council and the competent authorities have sent letters many times, requesting to carry out a number of "REITs pilot projects", which can be summed up in the two directions of "rental housing" and "infrastructure". China wants to start REITs from infrastructure projects, instead of starting REITs from commercial rental housing like other countries or regions that have REITs products, it is related to China's specific social mentality and special policy environment.

The State Council proposed to promote the pilot project of REITs, which originally started from the development of housing leasing. In June 2016, the State Council issued "Several Opinions on Accelerating the Cultivation and Development of the Housing Rental Market" (Guo Fa No. 39 Document), requiring "steady promotion of the pilot program of real estate investment trusts (REITs)". In January 2015, the Ministry of Housing and Urban-Rural Development of the People's Republic of China issued the No. 4 document "Guiding Opinions on Accelerating the Cultivation and Development of the Housing Rental Market", proposing to "actively promote the pilot of real estate investment trusts (REITs)". From this, it can be seen that what the management at that time wanted was to start the pilot REITs from the housing rental business. However, it encountered inconsistencies with the real estate regulation policy. After all, people were also guarding against "the flow of funds to real estate" at the time, and the issuance of rental housing REITs would definitely lead to the flow of funds to the real estate industry, allowing real estate companies holding basic rental housing assets to obtain funds. . It caused the pilot REITs to linger in policy contradictions.

The REITs research group of the Development Research Center of the State Council saw this situation as early as 2015 when it was established. I had a premonition that starting the REITs pilot project from rental housing would encounter ideological and policy obstacles, so I decided on a strategic topic and set the topic as "Research on the use of REITs to securitize government public assets and actively resolve local debt" . From the perspective of "public assets", the pilot REITs can be temporarily avoided in the field of commercial real estate, and the pilot target of REITs can be first locked in "government public assets", that is, infrastructure projects and public rental housing. The subject also specifically clarifies the role of "actively resolving local debts", describing it as "PPP of stock assets". This proved to be the right choice, and it really reduced the resistance to REITs pilots. After launching the pilot of infrastructure REITs, a "road with Chinese characteristics" has been taken into REITs.

Of course, "restricting the flow of funds to real estate" turned out to be the wrong policy. Especially in 2021, multiple competent departments and local governments will use regulatory measures to suppress the property market, and the superposition of policies will finally lead to the "fallacy of policy synthesis". In the second half of 2021, the negative consequences of the real estate control policy will appear, causing problems such as the cut off of funds, the deserted property market, land auctions, and financial difficulties, which affect the normal operation of the economy. At the end of 2021, the Central Economic Work Conference made a judgment: "China's economic development is facing triple pressures of demand contraction, supply shock, and weakening expectations."

Now REITs have completed pilot tasks in infrastructure projects, and have obtained the approval and encouragement of the State Council for comprehensive promotion. What we need is to keep our original aspirations in mind and make persistent efforts to include public rental housing and commercial rental housing in the REITs pilot program in accordance with the State Council's requirements of "accelerating the cultivation and development of the housing rental market" and "steadily advancing the real estate investment trust (REITs) pilot program". Launch the pilot of rental housing REITs in a timely manner.

Rental REITs have better long-term yields

The real estate asset securitization REITs business abroad mostly starts from leased houses. Various types of leased houses account for a large proportion in the REITs market, and the long-term returns are the best. Overseas data show that among REITs products, rental housing and rental healthcare facilities are the most profitable, mainly because of their obvious long-term value-added effects. A picture sent to me by Mr. Steven, President of the North American REITs Association, shows that if you invest $1 in the US REITs market in 1972, in 2014, 42 years later, its average total value will grow to $142. The chemical yield reached 12.2%. The total income includes three main factors: annual dividends, real estate appreciation and stock premium, of which real estate appreciation is the largest appreciation factor.

Analyzing the main holders of REITs in foreign markets, most of them are institutional holders such as pensions, insurance funds, and social security funds. Take all 221 REITs products with a total market value of $1.33 trillion in the United States in 2019 as an example. Their ultimate holders are 80 million Americans, who indirectly hold REITs through various pensions, insurance funds, etc. To this end, not only REITs are required to have good yields, but also governments of various countries have given REITs tax-free concessions in their operations. After all, 90-95% of REITs income is to be distributed to investors, and investors have to pay taxes when they get the income, so the exemption of REITs corporate tax avoids double taxation. These regulations are all conducive to maintaining the earnings of REITs. The Chinese government is also very concerned about the operation and earnings of REITs. It can be seen from the State Council's request that after the establishment of REITs, the State Council should increase the level of project income, ensure the stable operation of infrastructure, and protect public interests. The Ministry of Finance of the People's Republic of China has also issued a document to reduce or exempt taxes for projects entering the REITs pilot program in China, indicating that they are all concerned with safeguarding the interests of investors.

One of the reasons why REITs in various countries can have long-term stable returns is that the real estate assets they hold can appreciate in value over a long period of time, of which the rental housing sector has a special advantage. I have always believed that when China started REITs from infrastructure projects, it took a road that suits its national conditions, and it was also a difficult road. This is an evaluation of the low value-added rate of infrastructure projects. In the future, a large number of real estate assets can enter China's capital market through REITs, thereby realizing the requirements of the central government to "increase various property incomes such as urban and rural residential housing, rural land and financial assets". Of course, we must attach great importance to the long-term appreciation of REITs assets, and of course we must encourage the inclusion of the highest quality assets into REITs. The long-term rental housing that the state is encouraging, especially commercial rental housing, not only has stable rental income, but also has a high long-term appreciation rate. It should become the mainstream product in the future market of Chinese REITs.

As mentioned earlier, when the REITs pilot program was launched in China a few years ago, it had to bypass commercial rental housing projects and start REITs from infrastructure projects, in order to avoid conflicts with the real estate regulation policies at that time and affect the normal operation of the REITs pilot program. Now China's real estate policy has undergone great changes. According to the requirements put forward by the Political Bureau of the Central Committee and the State Council to "stabilize land prices, house prices, and expectations, and promote the healthy development and virtuous circle of the real estate market", the central bank and the China Banking and Insurance Regulatory Commission have changed from "strictly restricting capital flow to real estate" in 2021, "in accordance with the three red lines" Strictly manage real estate loans” has become the current “do not blindly withdraw, cut off, or suppress loans” and “keep real estate financing stable and orderly, and support rigid and improved housing needs.” Now the real estate market is not expected to improve, it is necessary to vigorously enhance the market confidence of the people. China has rich experience in regulation and control in dealing with the downward pressure on the economy, and the country will also introduce a variety of policy tools.

The current high debt ratio of real estate companies is the result of the lack of direct financing tools. It is said that the debt ratio of a large real estate company is as high as 93%. What I want to ask is, why can those entrepreneurs be the "bosses" with such a high debt ratio? Why can't he be the boss as a creditor who accounts for 93% of his company's total assets? This is the strange phenomenon caused by China's over-reliance on indirect financing. If such an enterprise is "too big to fail", other enterprises will take over with bank loans, and the people's bank deposits will be used to support the "disorderly expansion" of some enterprises, and in the end, they will even be diluted by issuing banknotes. Asset rights and interests are getting farther and farther away from "inclusive finance" and the ruling goal of our party.

The new economic situation and policy environment have made it impossible for us to promote the pilot of REITs for commercial rental housing. The contents of this pilot include: according to the work channel of the previous phase of the infrastructure REITs pilot, the high-quality stock assets of real estate companies, mainly various types of rental housing, are processed into REITs, which are held by social funds through the issuance of public funds. In this way, the real estate investment channels have been broadened, and the problem of high-debt real estate enterprises has been fundamentally solved. The entry of rental housing REITs into the capital market for circulation and transfer can expand the capacity of the capital market, give full play to the capabilities of REITs themselves, and promote the stability of the capital market. The advantage of rental real estate REITs is that they have great long-term value-added potential, can hand over better real estate assets to the society, and allow ordinary investors to enjoy real estate investment returns. It will be an inclusive capital benefit for the people.

If Chinese REITs reach this stage, they will be able to fully integrate with international REITs. Editor / Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~