- U.S. imposes two-year exemption from tariffs on PV modules in four Southeast Asian countries

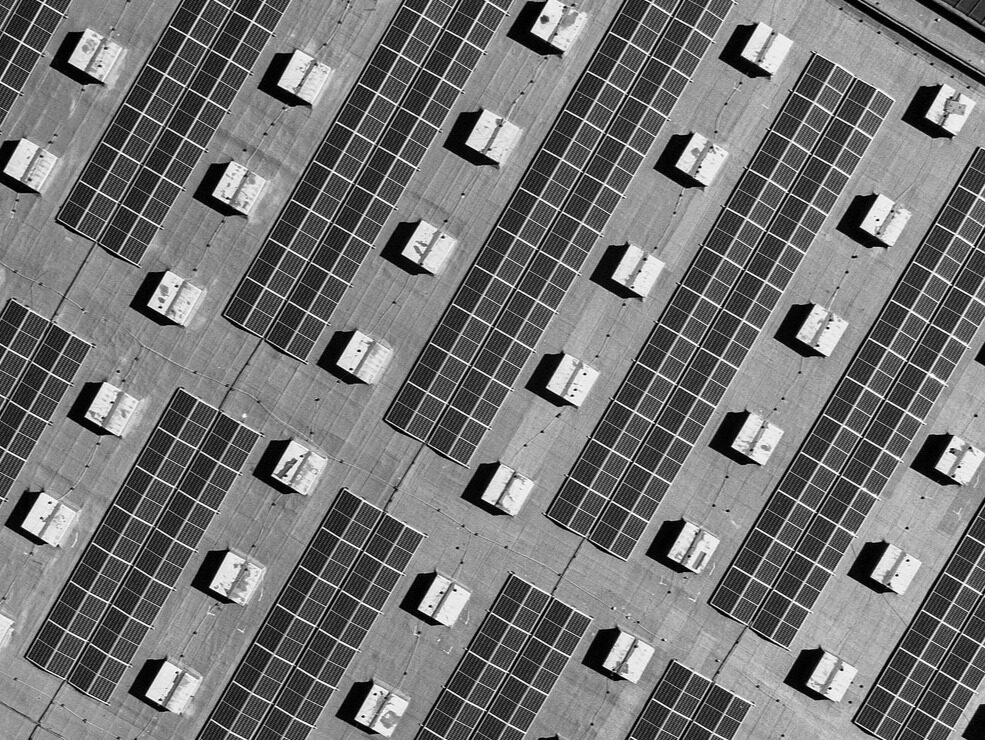

Recently, many overseas countries have issued relevant policies for Chinese enterprises. The United States has decided to exempt photovoltaic products from four Southeast Asian countries from new tariffs within two years and is preparing to ban the import of all products in Xinjiang from June 21, 2022. Europe has passed the "Anti-Forced Labor Customs". Measures Resolution", India decided to impose anti-dumping duties on China's solar fluorine-coated backsheets, Chinese enterprises' export trade is clouded over, and the international trade war broke out. In the face of such a severe market environment, Chinese photovoltaic enterprises will be able to rely on their strong competitive advantages. Steady and far-reaching, seek opportunities in crises, and open up new situations in changing situations.

Suspension of tariffs on Southeast Asia

On June 6, 2022, the White House of the United States issued a statement, in response to the previous proposal to open the anti-circumvention investigation of photovoltaic modules in four Southeast Asian countries, regardless of the final result, there may be new tariffs on photovoltaic cell modules in Thailand, Malaysia, Cambodia and Vietnam. This new measure is expected to promote the rapid development of the US photovoltaic market in the short term.

Recalling this incident, on March 28, 2022, the U.S. Department of Commerce (DOC) announced that it would initiate an investigation into Chinese PV module manufacturers’ actions to evade anti-dumping and countervailing duties by transferring some of their manufacturing operations to Southeast Asian countries. It will cover Cambodia, Malaysia, Thailand and Vietnam in four Southeast Asian countries, involving Trina, Canadian Solar, GCL Integration, LONGi, Jinko, JA Solar, Talesun, Chint and other leading photovoltaic product companies in China and even in the world, with far-reaching influence.

After the establishment of this anti-circumvention investigation, many project companies in the United States have postponed their purchase of goods due to the uncertainty of module companies, and the progress of installation is very worrying. Due to the major market disruption caused by the draft to the photovoltaic industry and its devastating impact on workers and businesses in various states, 19 governors jointly signed a letter urging the U.S. government to end the review of the anti-circumvention of photovoltaic tariffs as soon as possible, and finally the United States issued relevant policies, Suspended new tariffs on photovoltaic modules in four Southeast Asian countries, and proposed to vigorously develop photovoltaic production capacity in the United States to meet local demand as soon as possible, reduce imports, and promote employment.

Although the current anti-circumvention investigation has not stopped, no matter what the result is, the United States will not impose new tariffs on photovoltaic products in Southeast Asia in the past two years. Coupled with the growing demand for renewable energy in the United States, local production capacity cannot meet the needs of local production in a short period of time. Demand will still rely on imports for a long time, which is good for Chinese companies building factories in Southeast Asia, and shipments are expected to usher in rapid growth; on the other hand, the United States plans to ban the import of all products in Xinjiang from June 21, 2022 The problem of non-Xinjiang manufacturing is becoming more and more prominent. Although China has a huge non-Xinjiang production capacity, companies need to provide evidence to prove that the products exported to the United States do not contain ingredients produced in Xinjiang or listed entities, and the export of some components faces the risk of withholding. In the medium and long term, , after Chinese companies prepare sufficient supporting materials, export to the United States will also be safe.

India imposes tax on Chinese PV modules

Coincidentally, on June 15, 2022, the Ministry of Finance of India ruled on the "China Fluorine-Coated Backsheet Anti-dumping Case" submitted by the Indian Ministry of Commerce and Industry. damage, requiring a tariff of USD 762/ton on the fluorine-coated backsheets (excluding transparent backsheets) produced by Suzhou Zhonglai Photovoltaic New Materials Co., Ltd. imported from any country; imported from any country in China, non- The fluorine-coated backsheet (excluding transparent backsheet) produced by Jolywood New Materials Co., Ltd. is subject to a tariff of US$908/ton; the fluorine-coated backsheet ( Excluding transparent backsheets) is subject to a tariff of $908/ton; however, duties on transparent backsheet products are excluded.

In terms of production capacity, solar backsheets produced in China currently account for about 90% of the global market share, while India’s local backsheet production capacity is relatively small and cannot meet local demand for the time being. The raw materials, production equipment and core technology patents required for backplane production are all located in China. The production technology is mature, the scale effect is significant, and the advantages are obvious. It is expected that India's backplane production technology and production capacity will be difficult to surpass China in a short period of time. There is no way to fundamentally get rid of the Made in China problem.

At present, the United States, Europe, and India have issued relevant policies for China's photovoltaic industry. India's local industrial chain will achieve production capacity that rivals China's in the short term, and it does not have a competitive advantage in terms of technology and scale effects. Recklessly opposing the entry of Chinese photovoltaic products into the local market will have an adverse impact on the development of the local photovoltaic market. Made in China will still dominate.Editor/XuNing

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~