- Among them, the onshore wind power project is 37.9GW, and the offshore wind power project is 7.2GW

- A total of 272 wind power projects have been announced by major owners in China

The formulation of the dual carbon goal has brought new opportunities for the development of the wind power industry. 2022 is a critical year for China's wind power industry to break away from subsidies. According to incomplete statistics, from January 1 to June 30, 2022, the scale of wind power projects announced by major domestic owners reached 45.1GW, of which onshore wind power 37.9GW of projects and 7.2GW of offshore wind power projects; a total of 272 wind power projects were announced.

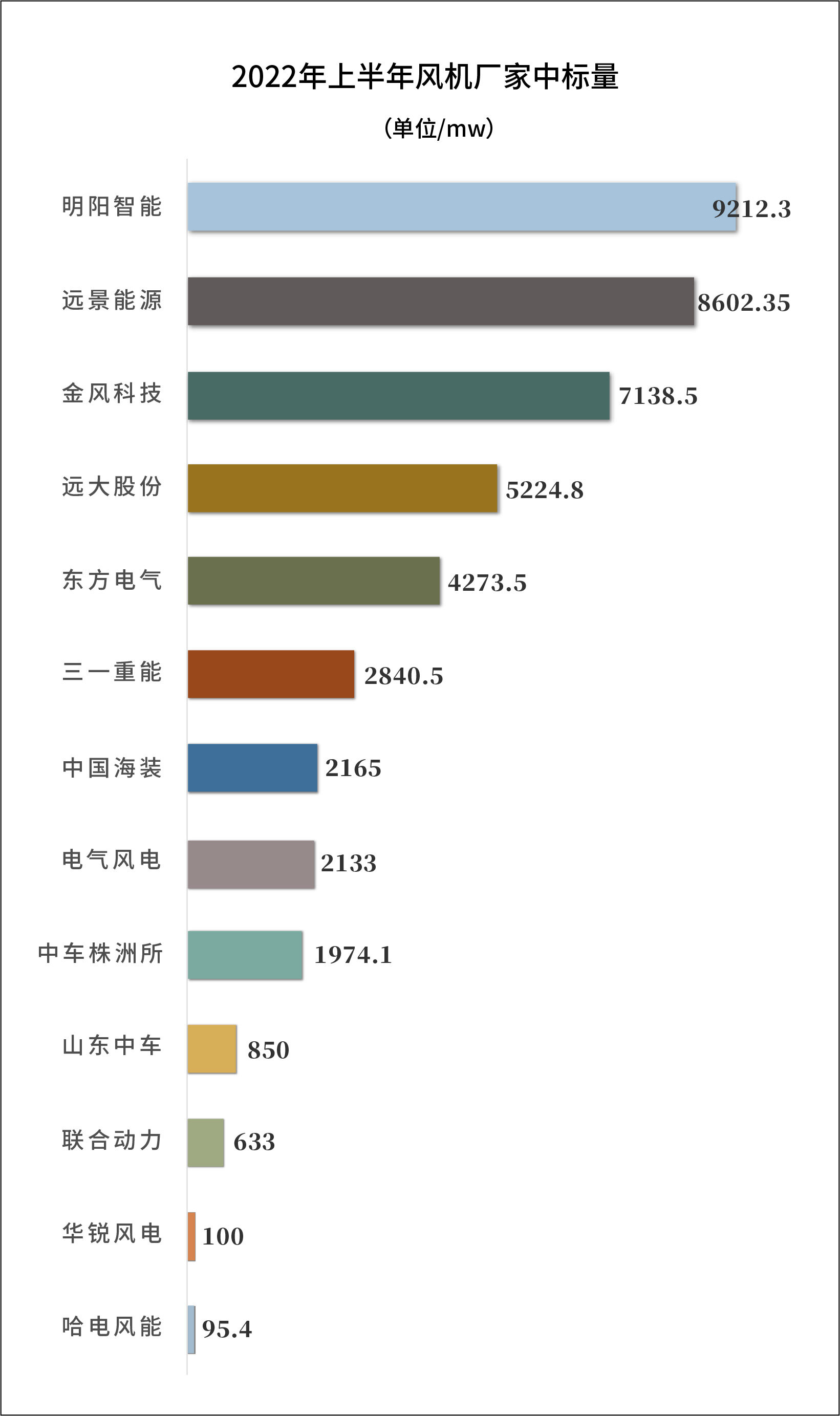

The data shows that in the first half of 2022, Mingyang Smart won the bid of 9.2GW of wind turbine orders, Envision Energy won the bid of 8.6GW of wind turbine orders, and Goldwind won the bid of 7.1GW of wind turbine orders; the three complete machine companies have a market share of 55.21%. Top three.

Second, Yunda won the bid for 5.22GW, Dongfang Electric won the bid for 4.27GW of wind turbines, Sany Heavy Energy won the bid for 2.84GW of wind turbines, China Haizhuang won the bid for 2.16GW of wind turbines, and Electric Wind Power won the bid of 2.13GW of wind turbines. The number of wind turbine orders won by Che-Zhuzhou Institute is 1.97GW, the number of wind turbine orders won by Shandong CRRC is 0.85GW, the number of wind turbine orders won by United Power is 0.63GW, the number of wind turbine orders won by Sinovel is 0.1GW, and the number of wind turbine orders by Harbin Electric Wind Power is 0.095GW.

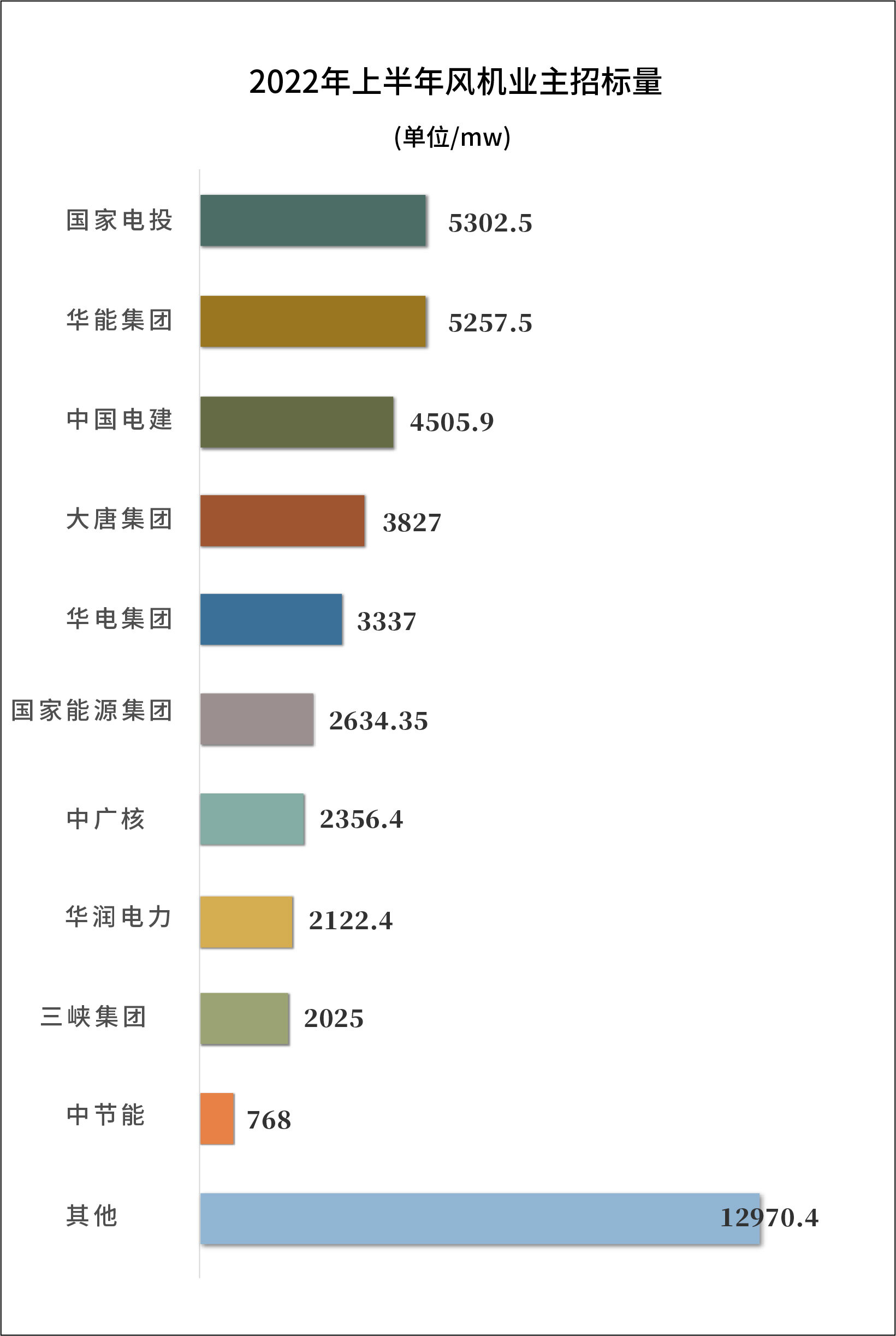

The data shows that in the first half of 2022, SPIC, Huaneng Group, and China Power Construction ranked the top three in terms of wind power bidding volume exceeding 4GW. The tender volume of the unit is 4.5GW.

Secondly, the bidding volume of wind turbines of Datang Group was 3.83GW, the volume of wind turbines of Huadian Group was 3.34GW, the volume of wind turbines of National Energy Group was 2.63GW, the volume of wind turbines of China Guangdong Nuclear Power was 2.36GW, the volume of wind turbines of China Resources Power was 2.122GW, and the volume of wind turbines of China Resources Power was 2.122GW. The group's wind turbines tendered 4.49GW, CECEP's wind turbines tendered 0.768GW, and other developers' wind turbines tendered nearly 13GW.

From the perspective of wind turbine prices, the price of wind turbines will generally decline in 2022, and the price per kilowatt of onshore wind turbines will remain at around 2,000 yuan/kW. Since the parity of offshore wind power, with the large-scale wind turbines, the price is almost halved, and the price is basically 4,000 yuan. -4500 yuan/kW range fluctuation. Editor / Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~