- In the face of China's huge industrial system, Mexico and Latin America are currently unable to undertake a large number of immigration

- In the long run, it is a challenge for China to face, but an opportunity for Mexico that cannot be missed

Affected by the interruption of the supply chain caused by the epidemic, the rising human cost in China and the Sino US trade conflict, the "offshore outsourcing" of the US Mexico manufacturing industry chain has once again become the focus of Mexico's attention. "Offshore outsourcing" refers to enterprises in a country that outsource their business to neighboring countries or regions with similar geographical location, time zone and language.

Reindustrialization strategy and "framework for revitalizing American manufacturing industry" put forward by the Obama administration of the United States; Go to the "US first" policy advocated by the Trump government, launch a Sino US trade war, attempt to de China and promote the return of manufacturing industry; As well as the national strategic security report issued by the Biden government, China was portrayed as the biggest challenge to the global order, and its national alliance relations were strengthened, and the initiative of returning to the Americas was issued. All signals indicate that the transfer and restructuring of the global supply chain are accelerating.

However, due to high labor costs, environmental protection, lack of industrial supporting facilities and other factors in the United States, it is difficult for a large number of manufacturing industries to return directly to the mainland in the short term. The near shore strategy is the most ideal way to use Latin America as the place to undertake the transfer.

Mexico has a special geopolitical and economic relationship with the United States, and its interests are highly integrated; The existence of the North American Free Trade Agreement; At the same time, Mexico has relatively complete infrastructure, high and cheap labor quality, and a young population age structure, all of which have made Mexico the first choice to undertake the return of the U.S. manufacturing industry chain.

Mexico is also very active in responding to the offshore outsourcing strategy of the United States. In addition to providing many tax incentives for enterprises leaving Asia to settle in Mexico, the government has also made a series of investments in infrastructure, and the policy side has announced its intention to continue to expand the scope of the border free trade zone.

A typical example is the automobile manufacturing industry. According to the requirements of the U.S. Mexico Canada Free Trade Agreement (T-MEC), more than 75% of the materials of automobile manufacturers must be originated from the U.S. Mexico Canada; In addition, there is also a requirement on labor value content, which stipulates that a certain proportion of finished cars must be manufactured by workers with an hourly income of at least $16 to be eligible for duty-free trade under the FTA. Therefore, more and more auto manufacturers and auto parts suppliers with North American businesses have transferred their offshore outsourcing factories in Asia to Mexico.

In recent years, less than one seventh of the manufacturing industries from China have actually moved to Mexico. Most of them have chosen other Southeast Asian countries or India. China's industrial manufacturing capacity and volume are far more than ten times that of Mexico. China's independent industrial system has also crushed any country in the world. Although the total industrial building area in Mexico is about 60 million square meters at present, the new building area for undertaking transfer projects in 2021 will be 735000 square meters, and the first quarter of 2022 will increase by 370000 square meters, it is obviously not an order of magnitude in the face of China's billions of industrial building areas.

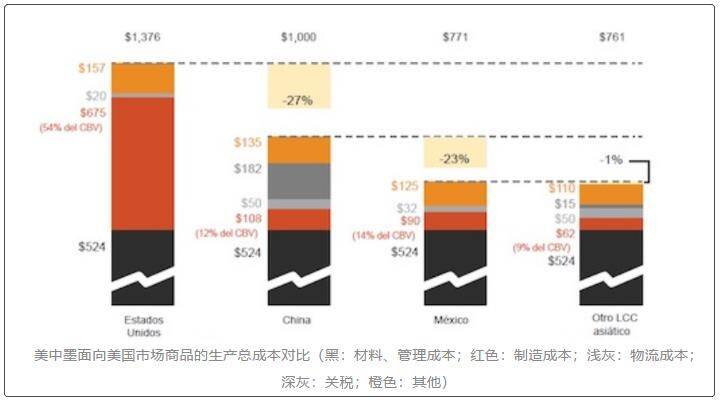

Due to differences in labor efficiency, tariff costs, and high shipping costs from Asia to the Americas, the cost of production in Mexico will save an average of 23% compared with that in China. However, in consideration of differences in material costs, industrial clusters, differences in domestic transportation costs, quality and output, Made in China still has some advantages.

The Mexican government and the business community are full of confidence in this, and various measures have achieved initial results. In the first half of 2022, Mexico's foreign direct investment will be 27 billion US dollars, an increase of 49.2% year on year. According to the data of the Inter American Development Bank, Mexico is expected to generate $35.3 billion in additional income annually through offshore outsourcing, accounting for almost half of the $78 billion in Latin America.

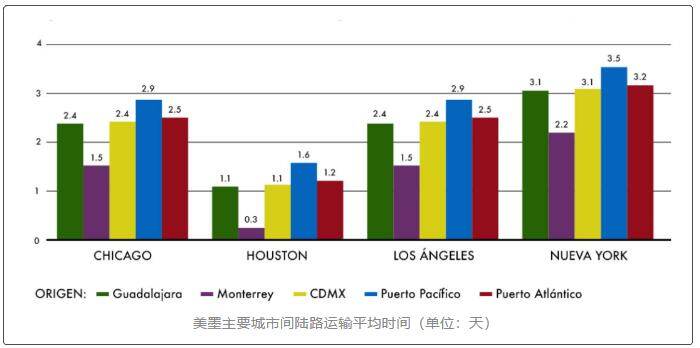

At present, Mexico is greatly improving its domestic logistics capacity, communication technology level, strengthening energy supply, seizing opportunities to promote economic growth, improve production capacity and technology level, and create employment opportunities, hoping to inject more confidence into foreign investment.

China Mexico relations are at a historical high. China is also taking advantage of this opportunity to actively respond to challenges. For example, take the initiative to gradually transfer high-quality production capacity to Mexico, and promote the joint construction of China Mexico Industrial Park and other projects; The infrastructure construction strategy of the Mexican government and the gradual deregulation of the infrastructure sector are also a good opportunity for Chinese enterprises to pursue their North American strategy.Editor/Xing Wentao

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~