- China Mining Resources invested 20 million US dollars to acquire 51% interest in URT lithium mine project in Mongolia

- China Mining Resources stated that obtaining a 51% interest in the URT lithium mine project will help the company continue to expand its advantages in mineral resources

China Mining Resources Group Co., Ltd. has business in more than 40 countries and regions in Asia, Africa, Europe, America, and Oceania, and has branches in China, Canada, the United States, the United Kingdom, Norway, Zambia, the Democratic Republic of the Congo, Zimbabwe, Uganda, etc. . Buying twice a year, China Mining Resources Mongolia repurchases lithium mines In order to further strengthen lithium mineral resource reserves and ensure multi-channel supply of lithium salt business raw materials, China Mining Resources acquired the URT lithium mine project in Mongolia for US$20 million on February 12, 2023 51% interest. The URT lithium mine project in Mongolia is held by Lithium Century LLC and Mongolian natural persons Tsogbat Manj, Urnaa Manj, and Ganbaatar Samdan, with the holding ratios being 60%, 20%, and 20% respectively.

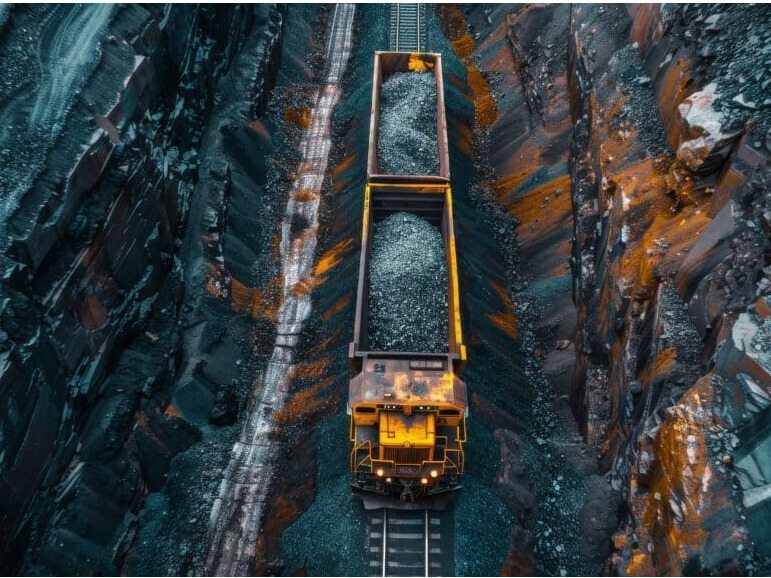

Mongolia URT lithium mine project

The prospecting potential of the purchased mineral area is great. The exploration right area of the URT lithium mine project is 332.02 hectares. After primary exploration by a professional geological team, the controlled + inferred lithium mineral resources are 1.743 million tons of ore, and the average grade of lithium oxide (Li2O) is about 0.9% (without third-party agencies. accreditation). At present, the exploration area accounts for 10.5% of the scope of the prospecting right. The rest of the area has been exposed by geophysical exploration and surface trenching. It has been confirmed that the surface outcrop and shallow greisen granite pegmatite contain lithium between 0.1-0.8%. , indicating that the areas beyond the discovered resources in the mining area still have great prospecting potential.

This is the second overseas lithium mineral resource acquired by China Mining Resources since 2022.

As early as the beginning of 2022, China Mining Resources acquired Zimbabwe Bikita Mining Co., Ltd. for US$180 million in cash, and owned 100% of its Bikita lithium cesium tantalum mine project in Zimbabwe. The Bikita project is currently in the production stage. China Mining Resources issued an announcement on the newly added resource reserves of the mineral in October 2022, indicating that the mineral resources have great potential and the development is gradually deepening.

Earlier in 2019, China Mining Resources acquired the Canadian TANCO mine by acquiring 100% equity of Cabot's special fluid business unit. The Canadian Tanco Mine has two relatively independent ore bodies of lithium ore and cesium garnet. The exploration and development of resources in the mining right area is relatively high. The mining area has a complete mining and dressing facility with a daily processing capacity of 700 tons of lithium ore and an annual output of 400 tons of cesium Chemical plant for salt fine chemical products.

On December 17, 2021, China Mining Resources subscribed for 7.5 million additional shares issued by the Canadian listed company PWM with its own funds of 1.5 million Canadian dollars, accounting for about 5.72% of the total share capital. Hong Kong Sinomine Rare and PWM signed an offtake agreement for all lithium, cesium and tantalum products of the Case Lake project.

In 2022, Canada, on the grounds of national security, requires Hong Kong Sinomine Rare, a wholly-owned subsidiary of Sinomine Resources, to divest its interests in the Canadian PWM company within 90 days. In December 2022, Hong Kong China Mining Rare Co., Ltd. will sell all its PWM shares, subscription warrants and rights and obligations under the "Underwriting Agreement" to the Australian Winsome Company for 2 million Canadian dollars, divesting all of its Canadian lithium holdings. mineral assets.

Achieve self-sufficiency, accelerate the deployment of overseas lithium mines, and achieve substantial growth in performance. In recent years, China Mining Resources has focused on the deployment of lithium battery new energy materials and cesium rubidium and other emerging material industries. With the goal of entering the first echelon of lithium battery raw material supply and realizing self-sufficiency in lithium ore resources, it has strengthened overseas geological exploration and mining rights development, and improved upstream and downstream industries. industrial chain.

Judging from the 2022 performance forecast of China Mining Resources, the annual net profit attributable to the parent is 3.25-3.75 billion yuan, an increase of 482.21%~571.78% year-on-year, and the net profit not attributable to the parent is 3.195-3.695 billion yuan, a year-on-year increase of 492.10%~584.76%. Profit growth is impressive.

Against the background of strong demand in the downstream new energy market, with the further increase in the output of the two major mines in Zimbabwe, Bikita and Canada's Tanco, and the future supply of lithium mines in Mongolia, the proportion of Sinomine Resources' self-owned mines will further increase. Editor/He Yuting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~