- Promote domestic gold prices higher than the global benchmark interest rate, making imported gold profitable

Five people familiar with the matter said that China has approved domestic and international banks to import large amounts of gold into the country, which may help support global gold prices after months of decline.

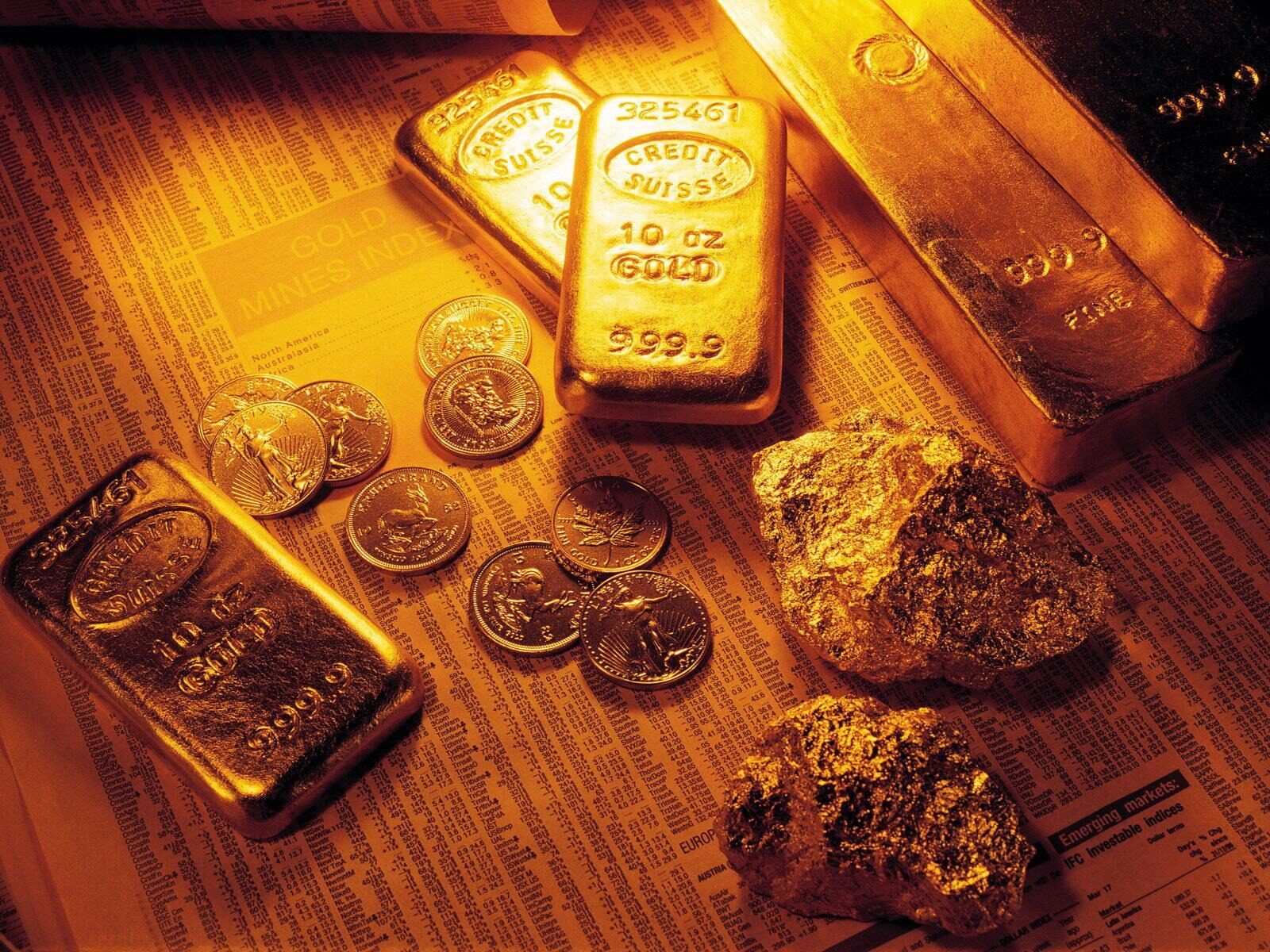

China is the world's largest consumer of gold, consuming hundreds of tons of gold each year, worth tens of billions of dollars, but with the spread of the coronavirus and the exhaustion of domestic demand, China's gold imports have fallen sharply. With the strong rebound of the Chinese economy since the second half of last year, the demand for gold jewelry, gold bars and gold coins has recovered, pushing domestic gold prices higher than the global benchmark interest rate, making imported gold profitable.

Gold traders in Asia said that the current local gold price premium is about 7 to 9 US dollars per ounce, and if it is not allowed to increase imports to meet demand, the premium may rise further. Four sources said that with Beijing’s approval, there are currently about 150 tons of gold, valued at US$8.5 billion at current prices. Two said that the gold will be shipped in April, and the other two said it will arrive in April and May.

Most of China's gold imports usually come from Australia, South Africa and Switzerland. China's Central People's Bank (PBOC) controls the amount of gold entering China through a quota system allocated to commercial banks. It usually allows metal to enter, but sometimes restricts flow. "For some time, we have no quotas. Now, we are getting...this is the highest level since 2019." said a source at one of the banks that shipped gold to China.

China returns to the global bullion market

According to Chinese customs data, since February 2020, the country's average monthly gold import value is about 600 million U.S. dollars, or about 10 tons. In 2019, its monthly import volume is about 3.5 billion U.S. dollars, or about 75 tons.

China’s absence had little effect on the price of gold in the early stages of the pandemic. At that time, Western investors worried about economic disasters and stored a large amount of safe-haven assets, pushing it to a record high of US$2,072.50 per ounce. But as the vaccine and the government's stimulus plan resumed economic growth, the price of gold has fallen to around US$1,750 per ounce, and investor interest has gradually disappeared.

According to sources in the Indian government, India's demand for gold bars has also rebounded from the pandemic-induced downturn, with a record 160 tons of gold imported in March. China and India usually account for about two-fifths of the world's annual gold demand. Standard Chartered Bank analyst Suki Cooper said that the recovery of gold is "critical to lay the foundation for gold" and will prevent prices from falling further in the next few months. Philip Klapwijk of Precious Metals Insights, a Hong Kong consulting firm, said that during the Lunar New Year holiday in February, China's jewelry sales performed better than in 2019 and 2020, and manufacturers and retailers need to replenish inventory.

He said: "A pretty good recovery in gold demand this year will require gold import levels to be generally higher than (2020)."Editor/Huang Lijun

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~